“Start-ups have emerged as a growth driver for the economy.” – Union Finance Minister Nirmala Sitharaman.

Union Finance Minister Nirmala Sitharaman presented the Union Budget 2022-23 at the Lok Sabha in the Parliament in New Delhi on February 1st, 2022. As the country’s economy is still struggling to find its way back from the crisis caused by the pandemic, we were expecting a budget that boosts morale not just of the business owners but also of the layman.

Finance Minister Nirmala Sitharaman unveiled the budget while highlighting the need to boost infrastructure. In this article, we will see how the Union Budget 2022-23 affects start-ups in India.

Before the budget presentation, there were quite some speculations and expectations from the start-up industry, including GST exemptions, low interest or interest-free loans for small businesses from smaller cities and towns, easy access to working capital, disparity reduction in capital gains for listed and unlisted firms, policy support for better capital participation, and much more.

Let us have a look at how the Union Budget 2022-23 will affect the Indian Start-Up Ecosystem-

1. Tax Incentive Timeline Extension

Until now, eligible start-ups established between 01.04.2016 and 31.03.2022 could claim tax benefits for the first three consecutive years within the first ten years since incorporation. The government has now extended this timeline until 31.03.2023, given the Covid-19 pandemic.

2. Encouraging Research And Development

Union Budget 2022-23 has opened up the Defence RnD for industries, start-ups, and academia with a dedicated budget of 25%, encouraging private industrial firms, start-ups, and students to design and develop military equipment and platforms with guidance from institutions such as DRDO.

3. Fund under NABARD

A fund with blended capital, raised under the co-investment model, will be facilitated through NABARD. This is to finance start-ups for agriculture and rural enterprise, relevant for farm produce value chain. The activities for these start-ups will include inter-alia, support for FPOs, machinery for farmers on a rental basis at farm level, and technology including IT-based support.”, said the finance minister. This will boost the start-up as well as the agriculture industry.

4. Drone Shakti: Promotion Of Drone As A Service (DrAAS)

Union Finance Minister Nirmala Sitharaman announced that the government is encouraging start-ups and established firms to develop applications for ‘Drones as a Service. She further asserted that training courses will be offered for the required skilling in select ITIs in all states.

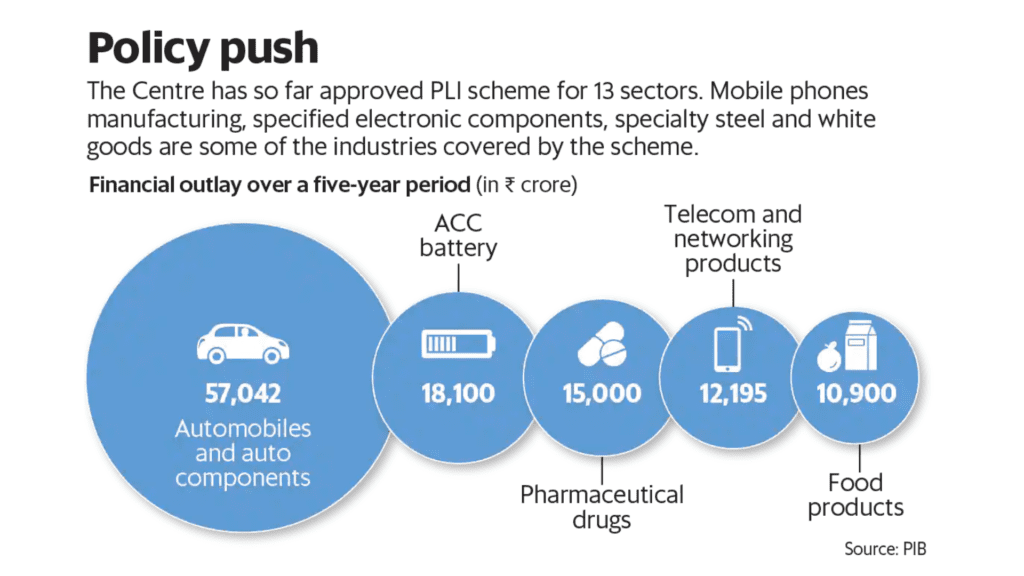

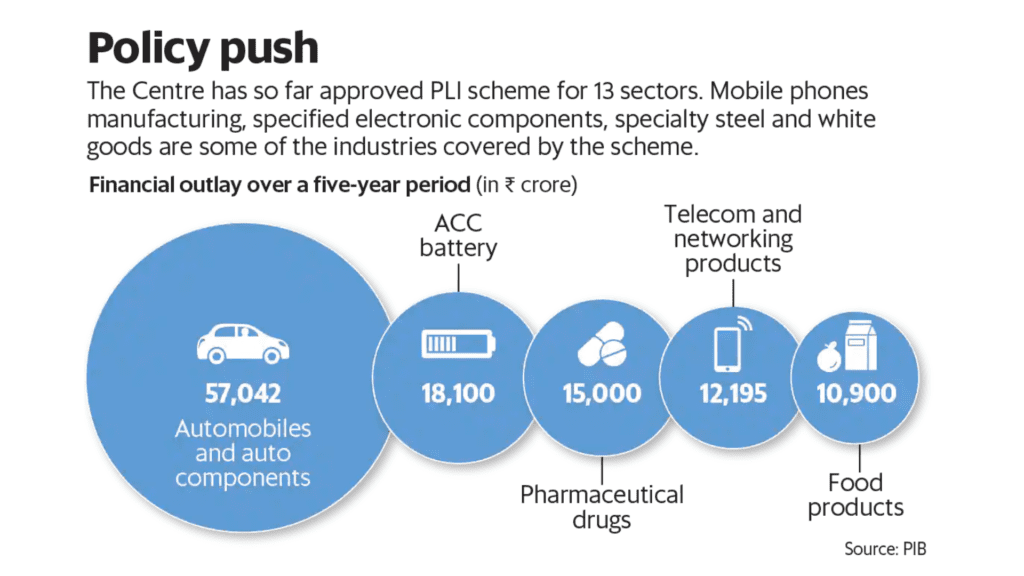

5. Allocations Under PLI Schemes

PLI Schemes – Production Linked Incentive Schemes – is an initiative by the government of India to encourage foreign companies to invest in the country and generate employment while promoting domestic and local production. The EV (Electronic Vehicle) industry start-ups will need to pay only 7.5% to customs duty compared to the previous 10%.

6. Start-Up India Seed Fund Scheme (SISFS)

The Startup India Seed Fund Scheme (SISFS) was first introduced in the Union Budget 2021 to provide financial assistance to start-ups for proof of concept, prototype development, product trials, market-entry, and commercialisation. The Startup India programme has Rs. 50 crore allocated for the financial year 2022-23, compared to the Revised Estimate of Rs 32.83 crore in 2021-22.

This change will promote innovation among start-ups by creating a growth-conducive ecosystem for budding entrepreneurs.

7. Reduction In Surcharge

The surcharge on long-term capital gains (LTCG) tax has been capped at 15% for all listed and unlisted companies. This reduction is a well thought out move since it will direct more money back into the ecosystem and make it available for further reinvestment in start-ups.

8.Tax Concession For New Manufacturing Units

Newly incorporated start-ups and companies setting up greenfield manufacturing units will have a special concessional tax rate of 15%. Owing to the pandemic, the government has under Section 115AB, extended the last date for commencement of manufacturing and production from March 31st, 2023 to March 31st, 2024.

9. Expert Committee

Union Finance Minister Nirmala Sitharaman announced that an Expert Committee would be set up to examine and suggest appropriate measures to boost venture capital private equity in start-ups.

These are very specific points from the Union Budget 2022-23 that have a direct connection with start-ups. However, many more declarations from the budget indirectly support and help various start-ups and small and medium businesses in India. Do you know any? Let us know in the comments down below!

Working from home and understanding these complicated BUT necessary factors from the budget is not easy. Co-Working Spaces like Oahfeo offer Meeting Rooms and Day Passes for remote workers. It’s a great place to get the conversation going and discuss finance with like-minded people. Visit www.oahfeo.com for more information!